US Imposes Sweeping New Tariffs as Major Partners Secure Side Deals, France Chides EU–US Trade Pact, US Issues Russia Ultimatum, Ukraine Faces Funding Shortfall, Russia–Ukraine Talks Stall, and More

Grinfi Political Risk Intelligence Briefing

Welcome to this week’s edition of Grinfi Political Risk Edge, your trusted source for expert political risk analysis and strategic intelligence. In this issue, we examine key geopolitical events shaping the defense, energy, and DeFi markets, providing a deep, beyond-the-headlines assessment. Anticipate, Adapt, and Excel!

But first, Happy August (Bon été)! Beginning this month, Grinfi Political Risk Edge launches a Special Section on France for Premium and Enterprise subscribers: L’Observatoire Décisif. This feature delivers exclusive political risk intelligence and strategic signals focused on the French market.

For our francophone audience, a dedicated French language edition, Grinfi Risque Politique Edge, is also available.

Now, let’s begin the week with a laugh 😄 to brighten the mood.

Help us serve you better and improve Grinfi Political Risk Edge by taking this brief, fully anonymized reader survey.

"We live in a world where there is more and more information, and less and less meaning."

Jean Baudrillard, Simulacra and Simulation. Translated by Sheila Faria Glaser. Ann Arbor: University of Michigan Press, 1994.

Disclaimer: The opinion expressed in this quote does not represent our views but is intended for reflection purposes only.

From Grinfi Political Risk Observatory (GPRO), here’s what we’re monitoring:

High Impact Situational Updates

MAJOR HEADLINES

— U.S. Implements Sweeping Tariffs on Key Trading Partners

On July 31, the United States finalized a major round of reciprocal tariffs ranging from 10%- 50% on imports from several countries. This is arguably the highest average import duty rate since the 1930s and will take effect beginning August 7, with select country adjustments already activated.

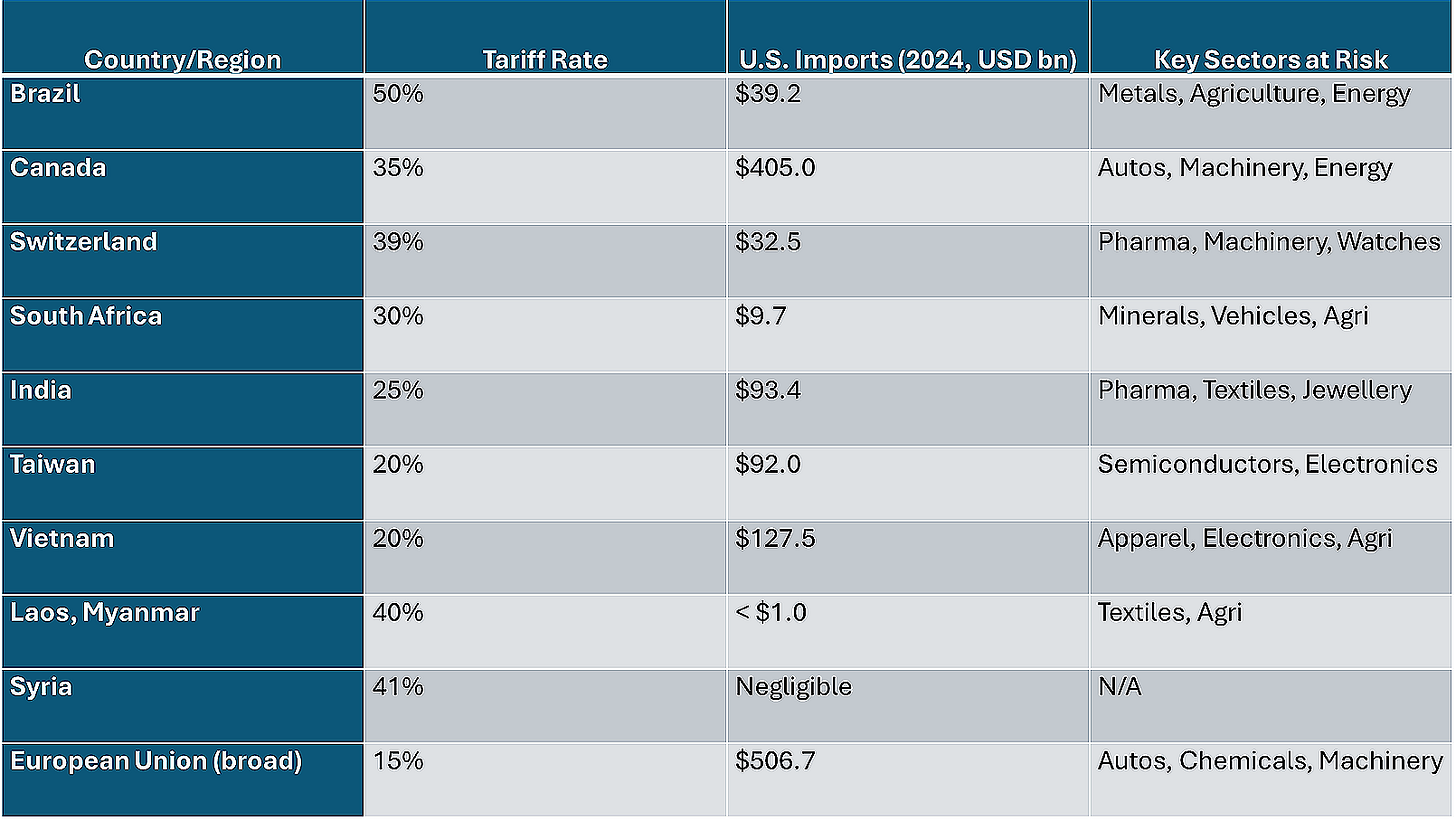

The table below highlights the principal trading partners (noting that the inclusion of Syria is an anomaly), 2024 import values, and sectors most at risk:

Nonetheless, some major economies have negotiated deals that reduce or phase out the US tariffs. This table reflects confirmed agreements as of the time of publication:

Still, both stable developed economies and major emerging markets are set to face severe disruptions. Which sectors remain the most vulnerable? Let us take a broader look at the exposure of key countries and regions affected by the tariffs.

US Tariffs: Exposure and Sector Impact by Country/Region

India

On July 31, the United States imposed a 25% tariff on Indian goods. This measure is also accompanied by strategic penalties related to India’s energy and defense ties with Russia.

Key export sectors at greatest risk include:

Textiles and Apparel: The United States is India’s largest export market, and this sector faces high vulnerability due to cost sensitivity and intense global competition. The agriculture sector is also expected to experience significant supply chain disruption.

Pharmaceuticals and Medical Devices: These account for approximately 10% of India’s exports to the United States and face direct price competition as well as regulatory hurdles.

Electronics and Components: Electronics represent about 14% of India’s exports to the United States and are subject to higher cost pass-through.

Gems and Jewellery: Roughly 13% of U.S. imports from India fall into this category, which faces medium to high sensitivity.

Refined Petroleum: This sector accounts for around 7.5% of India’s exports to the United States and is exposed to both price and policy shocks.

Market reaction: Indian equities fell, the rupee weakened to record lows, and from estimates, it appears that the tariff shock could reduce India’s GDP growth this year by 0.2–0.4%, though strong domestic demand may cushion the overall impact.