US and Russian Presidents Set to Meet, Israel Moves to Occupy Gaza, US Doubles Tarriff on India, Trump Opens 401ks to Crypto & Private Equity, US Issues $50m Bounty for the Arrest of Maduro, and More

Grinfi Political Risk Intelligence Briefing

Welcome to this week’s edition of Grinfi Political Risk Edge, your trusted source for expert political risk analysis and strategic intelligence. Clear, thorough, and industry-focused. In this issue, we examine key geopolitical events shaping global markets and provide deep, beyond-the-headlines assessment. Anticipate, Adapt, and Excel!

But first, our Market Commentary for July, which focuses on the U.S. equity market, has been published. Read it here.

Now, let’s begin the week with a laugh 😄 to brighten the mood.

Help us serve you better and improve Grinfi Political Risk Edge by taking this brief, fully anonymized reader survey.

"The crisis of geopolitics and geostrategy has given way to the emergence and dominance of chronostrategy."

Paul Virilio, The Information Bomb. Translated by Chris Turner. London: Verso, 2000

Disclaimer: The opinion expressed in this quote does not represent our views but is intended for reflection purposes only.

From Grinfi Political Risk Observatory (GPRO), here’s what we’re monitoring:

High Impact Situational Updates

MAJOR HEADLINES

— Israel’s Security Cabinet Approves Netanyahu’s Plan to Occupy Gaza

On August 8, Israel’s security cabinet authorized a military and administrative plan to assert control over Gaza, in what has been described as the “final operational phase” of the war, despite repeated warnings from senior IDF commanders. Prime Minister Benjamin Netanyahu declared that the operation aimed to “end Hamas’ operational capacity permanently.”

This follows months of blockades, targeted airstrikes, and ground incursions. Humanitarian agencies warn that over 70% of Gaza’s population is now displaced, raising the likelihood of international sanctions or embargo discussions against Israel at the UN.

Prime Minister Netanyahu's announcement also drew rapid pushback and condemnation from multilateral bodies, including the UN, the Arab League, key European capitals, and increases the odds of arms-export reassessments and targeted policy responses. Germany announced the suspension of certain arms export licenses that could be used in Gaza, while diplomatic channels in Washington have been pressing Israel to limit the scope of its operation.

At the same time, on July 31, Israeli company NewMed Energy, one of the Leviathan consortium partners, signed a historic $35 billion natural gas export agreement with Egypt. The Leviathan field will supply approximately 130 billion cubic meters (bcm) of gas to Egypt through 2040. The first shipment of 20 bcm is scheduled to begin in early 2026, with the remaining 110 bcm to follow once field expansion and the Nitzana pipeline to Egypt are completed.

Strategic Takeaway

The deal secures Egypt’s long-term energy feedstock and enhances its LNG export capacity, while anchoring Israel’s status as a key regional energy supplier. However, it could backfire on Egypt’s neutrality in the conflict.

Political pressure inside Egypt and across the region could still challenge the agreement’s durability if the Gaza conflict intensifies. There are also potential risks of higher marine insurance, schedule disruptions, and changes to routing in the Eastern Mediterranean. LNG and petroleum flows through the Suez and Levant corridors might face heightened sensitivity in the media, although the Egypt deal moderates that risk.

Meanwhile, the potential spillover effects of the expected Israeli occupation of Gaza remain high, despite Egypt’s subtle concession. Here are two scenarios to plan for:

If escalation spreads to Lebanon: Anticipate higher marine insurance costs and rerouting through the Red Sea.

If sanctions emerge: Monitor for sector-specific restrictions in defense, technology, and dual-use goods.

Action Roadmap for Corporate Stakeholders

For Logistics and Shipping Operators: Confirm insurance coverage for cargoes and adjust delivery timelines to accommodate potential delays. Activate security monitoring and route-risk assessment for East Med shipping lanes.

For Corporate Security and HR Teams of Firms Operating in the Region: Recheck duty-of-care, crisis response, and communication protocols for regional staff and partners to ensure readiness.

For Energy and Trade Contract Holders: Monitor shifts in Egyptian domestic sentiment that could trigger policy or contractual changes, even though such shifts appear unlikely at present.

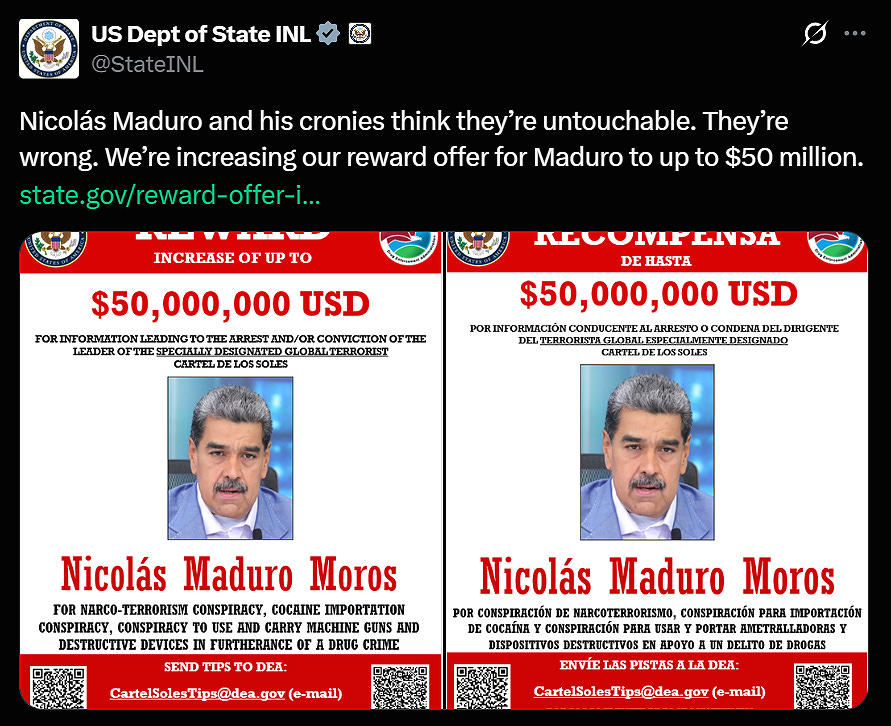

— US Offers $50 Million Reward for the Arrest of Nicolas Maduro

On August 8, the U.S. State Department doubled its reward to $50 million for information leading to the arrest or conviction of Venezuela’s president Nicolas Maduro on narcoterrorism charges.

The Venezuelan government condemned the move as “an act of aggression” and hinted at possible restrictions on oil exports to U.S. firms.

Caracas has also labeled the U.S. State Department’s decision as politically provocative and an “attack on Venezuela’s sovereignty.” Venezuelan officials maintained that Maduro remains in full control of the state and will not be subject to foreign legal processes.