Trump Announces 'Liberation Day' Tariffs, China Responds with 34% Retaliatory Tariffs, U.S. Targets Houthi Crypto Assets, Hungary Moves to Exit ICC, China Detains 3 Alleged Filipino Spies, and More

Grinfi Political Risk Intelligence Weekly Briefing

Welcome to this week’s edition of Grinfi Political Risk Edge, your trusted source for expert political risk analysis and strategic intelligence. In this issue, we examine key geopolitical events shaping the defense, energy, and DeFi markets, providing a deep, beyond-the-headlines assessment. Anticipate, Adapt, and Excel!

But first, let’s begin the week with a laugh 😄 to brighten the mood.

"We alone regard a man who takes no interest in public affairs not as harmless, but as useless."

Thucydides, History of the Peloponnesian War, Book II, Section 40.2 (circa 431 BCE), translated by Rex Warner in Thucydides: History of the Peloponnesian War (Penguin Classics, 1954, p. 145).

Disclaimer: The opinion expressed in this quote does not represent our views but is intended for reflection purposes only.

From Grinfi Political Risk Observatory (GPRO), here’s what we’re monitoring:

High Impact Situational Updates

MAJOR HEADLINES

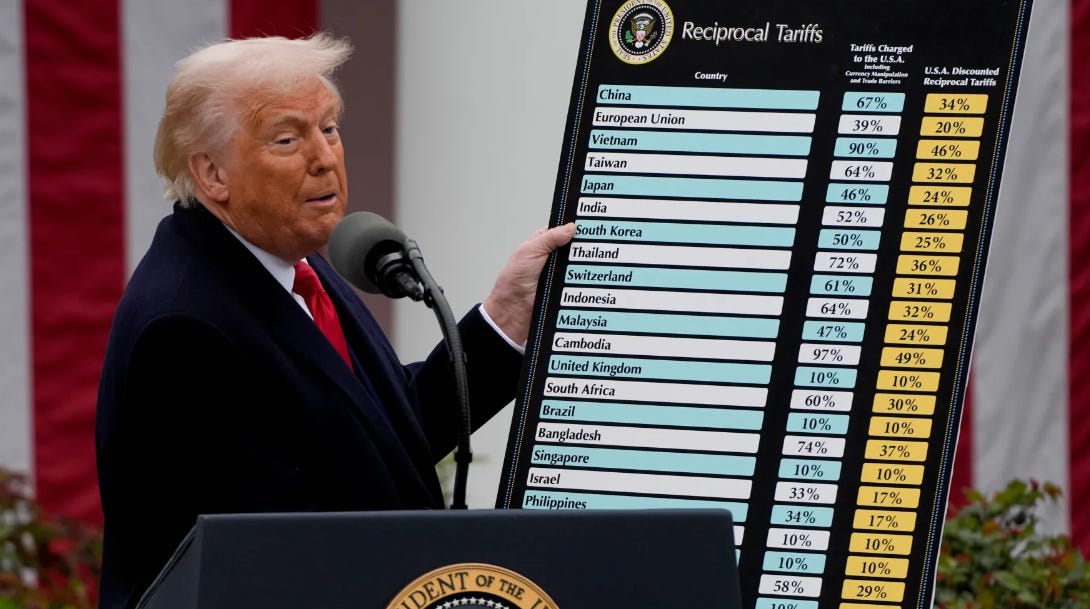

— Trump Announces ‘Liberation Day’ Tariffs

The global trade war has officially begun. On April 2, dubbed "Liberation Day," U.S. President Donald Trump announced a blanket 10% baseline tariff on all imports to the United States in a Rose Garden speech, alongside reciprocal tariffs mirroring foreign duties on U.S. goods, some reaching as high as 49%. U.S. Customs have begun collecting the 10% import tariff at all entry ports, with the higher levies scheduled to take effect on April 9. So far, over 50 countries are reported to be approaching the White House for negotiations over the tariffs, while others are preparing retaliatory packages in response. Trump has called the move "reclaiming America’s destiny" and "the dawn of economic reconstruction," further asserting that in order to “fix something,” Americans would have to “take medicines.”

Following the release of the tariffs, global markets reacted with volatility and turmoil. On April 3, the S&P 500 fell 4.8%, marking its worst drop since the COVID pandemic, while the Nasdaq lost ~6%. By April 4, the Dow Jones Industrial Average had plunged 2,231 points, slightly more than 5%, wiping out about $2.5 trillion in market value, and has still continued to decline. At present, Asian and European stock markets are still experiencing near-total market carnage, with Hong Kong’s Hang Seng Index reportedly facing its worst day since the Asian financial crisis in 1997, about 28 years ago.

U.S. Secretaries of State, Commerce, and Treasury have brushed off the market response, labeling it “maximum leverage” and arguing that markets will ultimately adjust. They also maintained that there is no reason to believe the United States is slipping into a recession. Commerce Secretary Howard Lutnick further indicated the administration’s intention to reshore semiconductor production from Taiwan.