Trade War or Economic Opportunity? Trump Suspends FCPA and Imposes 25% Tariffs on Steel and Aluminum

A Double-Edged Sword: What the U.S. FCPA Suspension and Tariffs Really Mean for Business

On February 10, President Trump signed two critical executive orders: one suspending broad enforcement of the Foreign Corrupt Practices Act (FCPA) and another reaffirming 25% tariffs on steel and aluminum imports. While suspending the FCPA suggests major progress toward deregulation in U.S. trade and regulatory policy (i,e. reducing compliance burdens for businesses) it also introduces significant legal and geopolitical risks.

For the metals industry, the reaffirmation of tariffs could have severe consequences. Key U.S. trading partners, including Canada, Mexico, Japan, South Korea, Germany, the UAE, and the fierce competitor, China, are major steel and aluminum exporters. Given that the U.S. imports a significant portion of its steel and aluminum, these tariffs will likely increase costs for domestic industries reliant on imported metals while also impacting exporters dependent on the U.S. market.

Retaliatory measures are also a major concern. Affected countries may respond by imposing tariffs on key U.S. exports, escalating trade tensions. How far could this trade conflict expand? The coming months will reveal whether these policies strengthen U.S. industries or provoke broader economic disruptions.

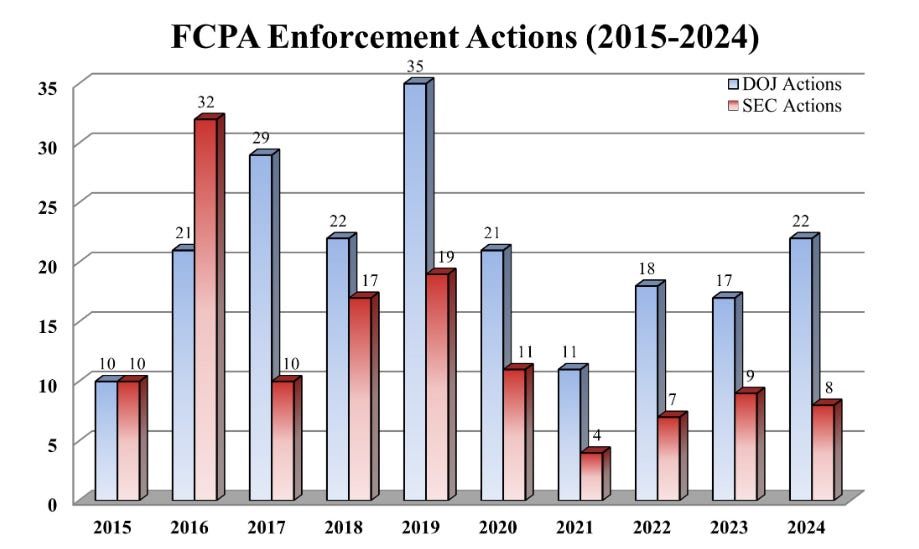

Following the executive order, Attorney General Pam Bondi issued a directive limiting FCPA prosecutions to bribery cases involving cartels and transnational criminal organizations (TCOs). This change narrows the scope of enforcement but maintains legal exposure for businesses in high-risk industries.

Let’s break this down, including the impact of the potential regulatory changes, the attendant supply chain risks, as well as de-risking strategies.