Trade War Drags On As Political Risk Premium Surges, U.S. and Iran Revive Nuclear Talks in Oman, Pentagon Cuts $5.1B Allocated to IT Consulting Contracts, Xi Jinping Heads to Southeast Asia, and More

Grinfi Political Risk Intelligence Weekly Briefing

Welcome to this week’s edition of Grinfi Political Risk Edge, your trusted source for expert political risk analysis and strategic intelligence. In this issue, we examine key geopolitical events shaping the defense, energy, and DeFi markets, providing a deep, beyond-the-headlines assessment. Anticipate, Adapt, and Excel!

But first, let’s begin the week with a laugh 😄 to brighten the mood.

"No nation can thrive if its markets are captive."

Charles de Gaulle, Press Conference, May 15, 1962, Élysée Palace, Paris, in Discours et Messages, vol. 3 (Paris: Plon, 1970), 123, archived in French National Archives, 5AG1/164.).

Disclaimer: The opinion expressed in this quote does not represent our views but is intended for reflection purposes only.

From Grinfi Political Risk Observatory (GPRO), here’s what we’re monitoring:

High Impact Situational Updates

MAJOR HEADLINES

— Trade War Drags On as Political Risk Premium Surges

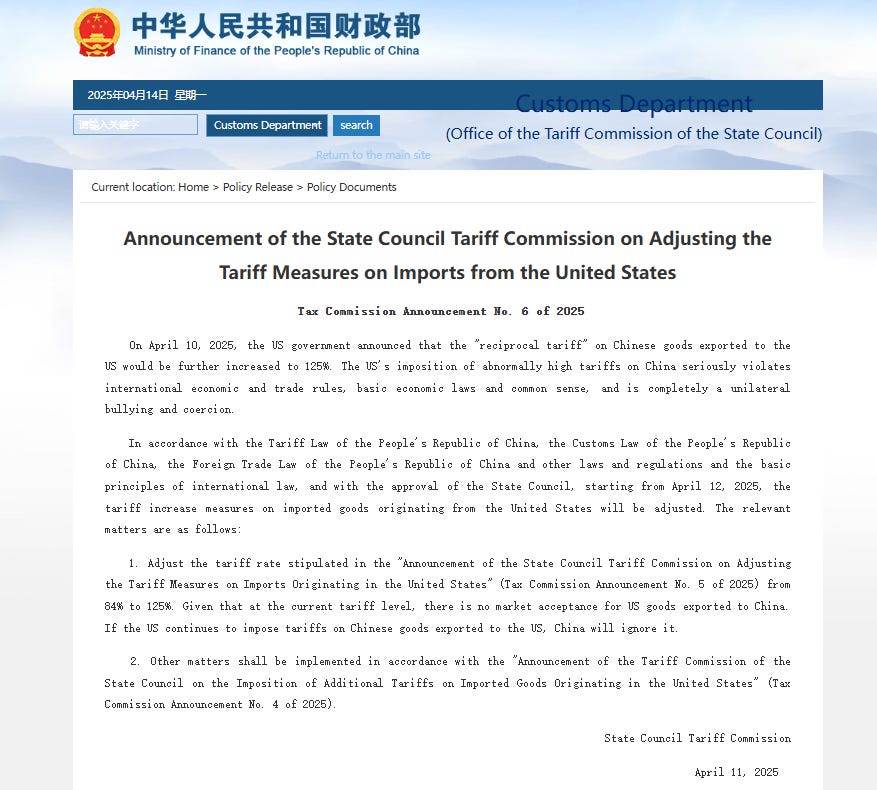

With the stock market under pressure as the global trade war accelerates and geopolitical fragmentation deepens, the political risk sign paradox (where a decrease in political risk typically correlates with higher stock market returns) is now operating fully in its true inverse. On April 10, the United States imposed a 145% tariff on Chinese imports, prompting China to retaliate on April 11 with a 125% tariff on U.S. goods.

Initial reports on April 13 indicated possible exemptions for electronic gadgets imported from China, but later clarifications from the White House confirmed that smartphones and laptops would remain subject to tariffs, further worsening market fears.

These developments have collectively triggered a surge in political risk premiums, as investors demand higher returns to compensate for growing loss of purchasing power in light of mounting geopolitical uncertainty. The U.S.–China trade war now threatens over $1 trillion in global trade, compounding inflationary and recessionary risks and supply chain instability across multiple sectors. The S&P 500’s implied equity risk premium (ERP) rose steadily from around 4.57% earlier this month. On April 8, the Nikkei dropped 7.83% and the Shanghai Composite fell 7.34%. Gold, however, has climbed to a little over $3,230 per ounce, a 15% year-to-date increase matching 2020 pandemic-era highs.

Meanwhile, rising disorder also appears to be plaguing the bond market, although less dramatic than the equity market. The 10-year U.S. Treasury yields rose to 4.51%, up 30 basis points by April 9, signaling investors’ anxiety over inflation, although part of the worries have now been eased, thanks to a gradual rebound. At the same time, the Federal Reserve has intimated that it might be forced to intervene to bring order in the financial markets if the treasury yield ever crosses 5%. Clearly, U.S. President Donald Trump’s push to shrink the trade deficit is starting to have second-order