Pope Francis' Death Deepens Political Polarization, Liberian Supreme Court Set to Deliver Crucial Final Ruling, DHL Pauses High-Value Shipments to US, Trump Escalates Feud With Fed Chair, and More

Grinfi Political Risk Intelligence Weekly Briefing

Welcome to this week’s edition of Grinfi Political Risk Edge, your trusted source for expert political risk analysis and strategic intelligence. In this issue, we examine key geopolitical events shaping the defense, energy, and DeFi markets, providing a deep, beyond-the-headlines assessment. Anticipate, Adapt, and Excel!

But first, let’s begin the week with a laugh 😄 to brighten the mood.

"You should not engage too frequently with the same enemy, lest he learn your tactics."

Napoleon Bonaparte, as quoted in Las Cases, E. (1823). Mémorial de Sainte-Hélène, Volume I, p. 234. Paris: Henri Colburn; English translation in Memorial of Saint Helena, Volume I, p. 256 (translated by Anonymous). Boston: Wells and Lilly

Disclaimer: The opinion expressed in this quote does not represent our views but is intended for reflection purposes only.

From Grinfi Political Risk Observatory (GPRO), here’s what we’re monitoring:

High Impact Situational Updates

MAJOR HEADLINES

— Pope Francis Dies: Can the Vatican Withstand the Growing Internal Political Polarization?

Early this morning, April 21, the Vatican confirmed the death of Pope Francis at age 88, from a stroke and heart failure. His passing triggers a sede vacante period.

Pope Francis’ ardent social justice advocacy and progressive stances have polarized the Church, sparking both internal religio-political divisions and clashes with conservative global leaders.

The pope’s death sets the stage for a contentious conclave to elect his successor. Reports suggest that Francis appointed around 80% of the current cardinal electors, giving him significant influence over the College of Cardinals. This raises the likelihood of a progressive, potentially non-European, pope. However, conservative cardinals may push for a traditionalist successor to reverse his reforms, deepening internal divisions.

This ideological divide could weaken the Vatican’s moral authority, shift (though unlikely) its diplomatic stance on issues like climate change and migration, and potentially fuel unrest in Catholic strongholds in Latin America and Europe, where polarized sentiments are intensifying.

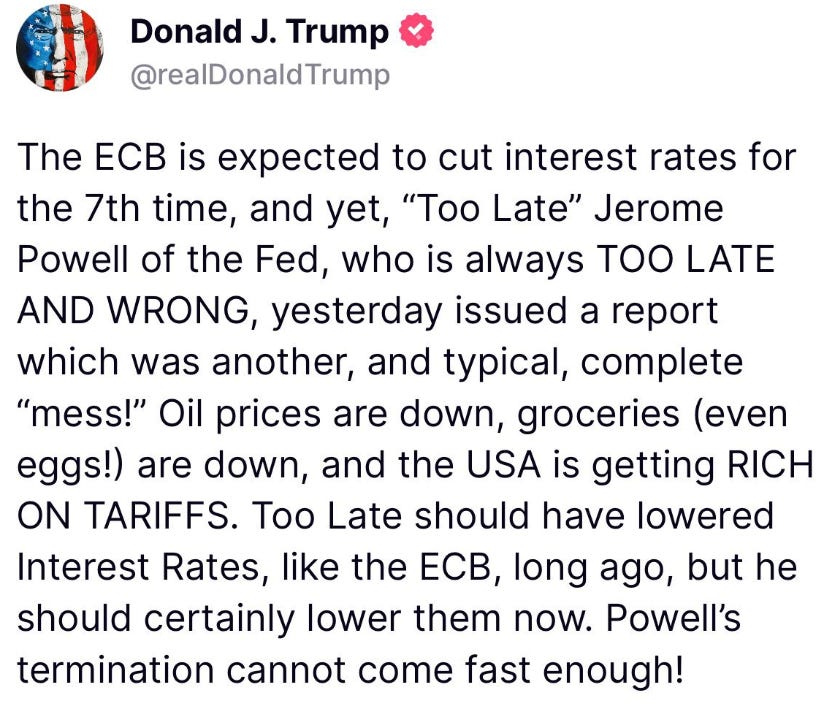

— Trump Escalates Feud with FED Chair

U.S. President Donald Trump has intensified his criticism of Federal Reserve Chair Jerome Powell, demanding immediate interest rate cuts and declaring Powell’s “termination cannot come fast enough.” In a Truth Social post and Oval Office remarks, Trump taunted Powell as “always TOO LATE AND WRONG,” citing falling oil prices and claiming tariffs are enriching the U.S. He contrasted the Fed’s inaction with the ECB’s seventh rate cut.

Powell, whose term ends May 2026, reaffirmed the Fed’s independence, noting legal protections against removal. Earlier on April 16, Powell in a speech at the Economic Club of Chicago warned that Trump’s tariffs (10% global, 145% on China) risk stagflation, prompting a wait-and-see stance as rates hold at 4.25%-4.5%.

Treasury Secretary Scott Bessent has reportedly cautioned the President against firing Powell, citing market risks, while the IMF warned of eroding central bank credibility. In market response, Asian and U.S. stock futures, along with the dollar, fell sharply today, April 21, as investors’ confidence dampened following the president’s attacks on Powell.

In related news, the president has also doubled down on an executive order that stops the federal government from issuing paper cheques, effective September 30, and mandates a full shift to fast electronic payments through direct deposit, debit card, digital wallet, or real time transfers.

— Indian Central Bank (RBI) Governor Warns of Liquidity Risks

On April 19, Reserve Bank of India (RBI) Governor Sanjay Malhotra warned of shrinking money market liquidity during a crucial address at a financial conference in Mumbai. The warning came in the wake of escalating U.S.–China trade tariffs affecting India’s economy and ahead of U.S. Vice President JD Vance’s visit, scheduled for today, April 21, to recalibrate India–U.S. trade relations.

Malhotra’s speech centered on urging banks to strengthen monetary policy transmission mechanisms but offered no immediate interventions, signaling that further measures may be forthcoming. The conference, attended by RBI officials and senior banking executives, focused on rate disparities across call money, repo, and TREPS (Tri-party Repo) markets.

India’s banking system is currently running a daily liquidity surplus of ₹1.7 trillion ($20.4 billion), according to the latest RBI data. Foreign exchange reserves stand at $676.3 billion (RBI), and the International Monetary Fund (IMF) projects