Myanmar and Guinea Hold Elections, Israel Recognizes Somaliland, US Launches Christmas Day Strikes, EU-US Relations Suffer Another Setback, Zelensky Meets Trump for Talks, and More

Grinfi Political Risk Brief Year-End Edition

Good Morning!

Welcome to this year-end edition of Grinfi Political Risk Edge, your trusted source for expert political risk analysis and strategic intelligence. Thorough, insightful, and industry-focused. We deliver clarity in uncertainty and strength in decision-making. Anticipate, Adapt, and Excel!

Read our 2025 Annual Report/Geostrategic Review as you set your priorities for the year ahead. Full access is available to premium and enterprise subscribers, along with other vital political risk resources designed to support and inform your strategic and investment decisions in 2026.

But first, let’s begin the week with a laugh 😄 to brighten the mood. Remember, a little humor never hurts before moving on to the serious stuff.

From Grinfi Political Risk Observatory (GPRO), here’s what we’re monitoring:

High Impact Situational Updates

“At Grinfi, we track immediate fragility and systemic contagion to ensure leaders see risks before they spread.”

EXECUTIVE SUMMARY

Here are the key issues you should know about that are expected to shape political risk this week.

Overall, two active conflicts that have dominated our reports in recent weeks, Russia-Ukraine and the Thailand-Cambodia wars, showed tentative signs of diplomatic de-escalation over the weekend, although military tensions on the ground remain high and neither process has been fully operationalized.

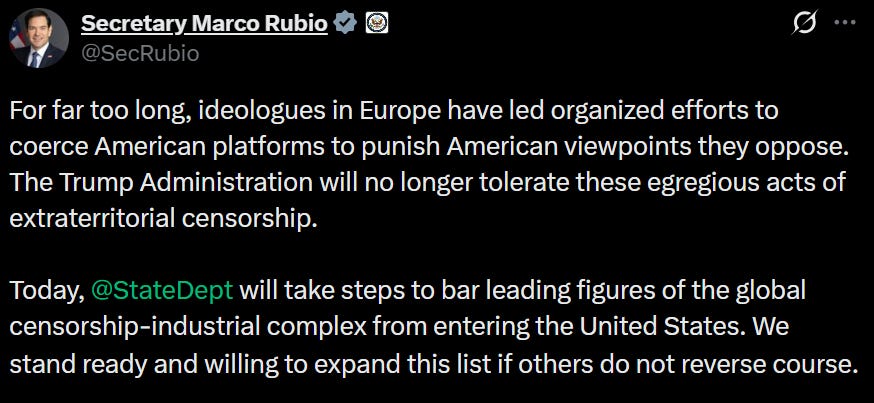

The Trump-Zelensky meeting yesterday delivered more substance than many expected, with security guarantees reportedly settled (despite other thorny issues) and follow up talks in Washington scheduled for January. In Southeast Asia, the ceasefire appears to be holding for now, but the seventy two (72) hour test period will determine whether it endures. In transatlantic affairs, the United States has imposed visa bans on several European officials over their support for the Digital Services Act, which Washington believes unfairly targets American companies.

Some European officials are now calling for full retaliation.

Pressure is building across the Asia-Pacific region. Japan has just become the world’s third largest defense spender following the approval of a record defense budget for fiscal year 2026. China imposed sanctions on twenty (20) American defense firms over Taiwan’s arms sales. North Korea appears close to launching sea trials for a new submarine. In Taiwan, the opposition has initiated impeachment proceedings against President Lai.

Meanwhile, the junta-organized elections in Myanmar and Guinea unfolded exactly as anticipated. In Myanmar, there was reportedly a low turnout, contrary to the narrative of the military leadership. In Guinea, Doumbouya is set to secure a seven (7) year mandate. Neither outcome appears poise to strongly alter sanctions exposure or reputational risk for companies in these markets.

Watch this week: Guinea results expected within seventy two (72) hours. Year-end positioning in thin markets. Bulgaria adopts the euro January 1. January catalysts include: Myanmar Phase 2 (January 11), the Yoon verdict in Seoul (January 16), and Washington peace talks on Ukraine, among others.

Another critical development emerged from the Horn of Africa, placing the region firmly on our risk radar. Israel recognized Somaliland on Friday (December 26),