Israel to Become a Pariah 'Super-Sparta', Fed Slashes Rate as Global Equity Surges, US-China to Finalize TikTok Deal, EU Mulls Suspending Free Trade with Israel, Chad Removes Term Limits, and More

Grinfi Political Risk Intelligence Brief

Welcome to this week’s edition of Grinfi Political Risk Edge, your trusted source for expert political risk analysis and strategic intelligence. Thorough, insightful, and industry-focused. In this issue, we examine key geopolitical events shaping global markets and provide deep, beyond-the-headlines assessment. We deliver clarity in uncertainty and strength in decision-making. Anticipate, Adapt, and Excel!

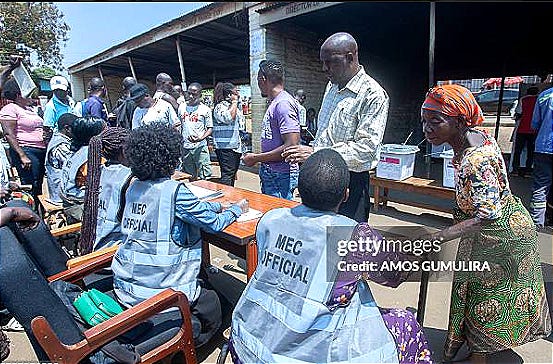

But first, read our latest commentary on the Malawian tripartite general elections conducted under the novel absolute majority system (50% plus one), following the chaos of the plurality system in the 2019 general elections.

Now, let’s begin the week with a laugh 😄 to brighten the mood.

Help us serve you better and improve Grinfi Political Risk Edge by taking this brief, fully anonymized reader survey.

"The Spartans do not ask how many the enemies are, but where they are."

Plutarch. Moralia. Translated by Frank Cole Babbitt. Vol. 3. Loeb Classical Library 245. Cambridge, MA: Harvard University Press, 1931.

Disclaimer: The opinion expressed in this quote does not represent our views but is intended for reflection purposes only.

From Grinfi Political Risk Observatory (GPRO), here’s what we’re monitoring:

High Impact Situational Updates

EXECUTIVE SUMMARY

Last week, several strategic events reshaped the global risk environment with direct consequences for security, markets, and regulation.

“At Grinfi, we track immediate/direct fragility and systemic contagion (cascading effect), ensuring leaders see risks before they spread.”

In the United States, credible reports indicate that the Trump administration is preparing an executive order to curb political violence in the aftermath of Kirk’s murder. Several senior officials, including the Attorney General, have called for a crackdown on hate speech, which remains protected under the First Amendment. Civil society groups are cautious, warning that any arbitrary or partisan measure could undermine constitutional protections and stifle legitimate dissent. In parallel, the President signed an order banning the burning of the American flag, a move almost certain to face constitutional challenges. Supreme Court precedents in Texas v. Johnson (1989) and United States v. Eichman (1990) established that flag burning is protected under the First Amendment, with the Court each time reaffirming that neither Congress nor the President can restrict constitutional rights through statute or executive order.

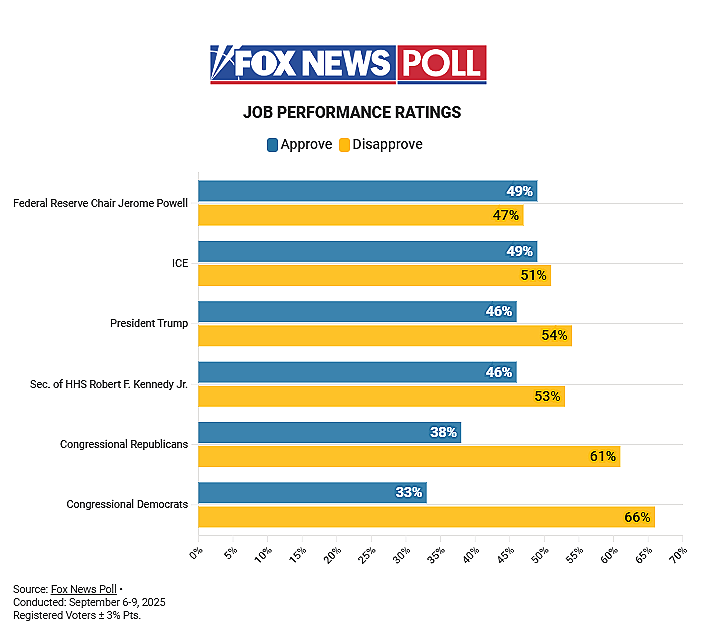

A new Fox News poll released earlier in the week showed Republican confidence in both the President and the country’s direction is falling, driven by concerns over immigration, crime, and the economy. The administration also issued an executive order introducing a $100,000 H-1B visa fee, intended to ensure local firms prioritize American workers while restricting entry to high-value foreign talent. Officials later clarified that the fee would not apply to current visa holders re-entering under valid documents.

Concurrently, the Federal Reserve cut rates by twenty-five basis points (25 bps), lowering the federal funds range to 4.00–4.25%. Chair Jerome Powell described the move as “risk management,” citing a softening labor market even as inflation remains above target. Equities and credit spreads strengthened on the decision, while Treasury yields climbed and mortgage costs remained largely unchanged. Markets now anticipate a further half-point of easing before year end.

Meanwhile, preliminary reports confirm that the U.S. and China have reached a framework agreement under which TikTok’s U.S. assets would be transferred to American ownership, allowing the app to remain operational in the U.S. under stricter oversight. The deal is expected to give U.S. citizens a majority of board seats and transfer control over TikTok’s algorithm and U.S. user data to American entities, while ByteDance retains a minority stake. A consortium of U.S. firms, including Oracle, is central to the deal, and their shares have outperformed this week on expectations of regulatory approval and prospective commercial gains. However, this momentum remains vulnerable to political or regulatory setbacks, including potential resistance from Beijing or additional conditions imposed in Washington.

At the moment, the juxtaposition of intensifying political polarization, rising immigration compliance costs, and looser monetary policy shifts the U.S. from a low- to a medium-risk environment, according to Grinfi’s latest political risk assessment. This environment is currently defined mostly by regulatory uncertainty and governance strain masked by short-term financial buoyancy. Exposure to sudden policy shocks remains a clear risk despite supportive markets.

In the United Kingdom, as part of President Trump’s visit from September 16-18, the U.S. and UK signed a £42 billion technology pact spanning artificial intelligence, quantum computing, and civil nuclear energy, alongside £150 billion in investment pledges by U.S. companies.

In the Middle East, Prime Minister Benjamin Netanyahu delivered his “Super-Sparta” speech, warning that Israel faces growing diplomatic and economic isolation and is fast becoming a global pariah. He called for greater self-reliance and expanded defense production. He invoked the Sparta analogy as part of the government’s new posture of militarization and strength, a policy geared toward building internal power. At the same time, the Israeli military escalated its campaign in Gaza City with warnings of “unprecedented force” and orders for civilian evacuation. The United Kingdom, Canada, and Australia have now formally recognized the State of Palestine at the UNGA, deepening Israel’s isolation. Earlier, an emergency Arab-Islamic summit in Doha condemned an Israeli strike and pledged solidarity with Qatar’s mediator role. Meanwhile,

The Israeli stock market experienced another decline this week, with the Tel Aviv Stock Exchange 35 Index falling 1.8% on Wednesday, September 17, marking its sixth consecutive day of losses, arguably the longest losing streak in 18 months. The market's downturn spanned multiple sectors, with 18 of the 35 stocks in the benchmark index falling, as growing investor concerns over the prolonged war in Gaza and its economic impact intensify.

In Europe, the EU Commission has proposed suspending Israel’s free-trade privileges over humanitarian concerns. France, during the course of the week, saw nationwide strikes against budget cuts, disrupting transport and schools and resulting in more than one hundred and forty (140) arrests. In other news, Estonia has reported airspace violations by Russian MiG-31 jets near Vaindloo Island and requested NATO Article 4 consultations. Meanwhile, the EU Court of Auditors has reported that the bloc is failing to meet “aid for trade” commitments to the world’s poorest nations.

In Turkey, tens of thousands protested in Ankara against judicial moves targeting the opposition CHP party. On September 21, the Republican People’s Party re-elected Özgür Özel as leader in an extraordinary congress, bolstering him ahead of a decisive October 24 court ruling that could annul the 2023 congress and his leadership.

In Africa, Malawi voted on September 16 in a general election defined by inflation above 20%, fuel shortages, and repeated climate shocks. By September 21, partial results showed former president Peter Mutharika leading, though both major parties claimed victory prematurely. On September 16, Chad’s National Assembly removed presidential term limits and extended terms from five to seven years, enabling Mahamat Idriss Déby to run indefinitely. That same day, Senegal intercepted a pirogue carrying one hundred and twelve Gambian migrants after five days at sea. In Nigeria, the government has lifted the state of emergency rule in Rivers State. On September 18, sixteen (16) African countries endorsed the African Petroleum Regulators Forum (AFRIPERF) charter during Africa Oil Week in Accra, marking a significant step toward harmonizing oil and gas regulations to improve transparency and attract investment across the continent.

At the same time, Moody’s warned that major Sub-Saharan economies face surging borrowing costs, complicating debt service and investment.

In Asia, dovish central banks and the Fed’s cut lifted equities toward record highs. Thailand on September 19 announced its cabinet would present a policy program by September 29. In Taiwan, President Lai Ching-te reaffirmed that the island would never capitulate to Chinese pressure and closed a week of defense events emphasizing readiness.

In Latin America, authorities in Argentina disclosed that its central bank had sold more than $2 billion in reserves to defend the peso, which lost 9% in two weeks. Sovereign bond yields spiked by 5.5 points as default fears mounted. In Brazil, the central bank surprised markets by holding rates steady, tempering expectations for further easing. Venezuela conducted large exercises on La Orchila Island, and, in a surprise turn, President Nicolás Maduro offered to engage in direct talks with a U.S. envoy following American accusations of narcotics ties.

Global markets capped the week with record

End of Free Briefing

Become a paid subscriber today to gain complete and unrestricted access to the full briefing with detailed strategic takeaways, sector-specific action roadmaps, board-ready guidance (“What to Tell Your Investors or Board this Week”), and our comprehensive market summary, as well as the exclusive France-special section: L’observatoire Decisif...