Farmers Furious Over EU Mercosur Deal, Thailand Set for Snap Election, EU Agrees on New Funding for Ukraine, US Erects Blockade on Venezuela, France’s Stopgap Bill Likely, and More

Grinfi Political Risk Brief

Good Morning! Happy Holidays from Grinfi Consulting!

Welcome to this Pre-Christmas edition of Grinfi Political Risk Edge, your trusted source for expert political risk analysis and strategic intelligence. Thorough, insightful, and industry-focused. We deliver clarity in uncertainty and strength in decision-making. Anticipate, Adapt, and Excel!

But first, let’s begin the week with a laugh 😄 to brighten the mood. Remember, a little humor never hurts before moving on to the serious stuff.

From Grinfi Political Risk Observatory (GPRO), here’s what we’re monitoring:

High Impact Situational Updates

“At Grinfi, we track immediate fragility and systemic contagion to ensure leaders see risks before they spread.”

EXECUTIVE SUMMARY

Here are six key issues you should know about that are expected to shape political risk this week.

1. Ukraine peace talks enter a critical phase. U.S., Russian, and Ukrainian negotiators concluded “constructive” talks in Miami over the weekend, but the Kremlin rejected European amendments to the proposed deal.

All eyes are expectantly on signals as to whether full-on trilateral talks (U.S.-Ukraine-Russia) will proceed. Any breakthrough would reshape European defense spending, sanctions policy, and energy markets.

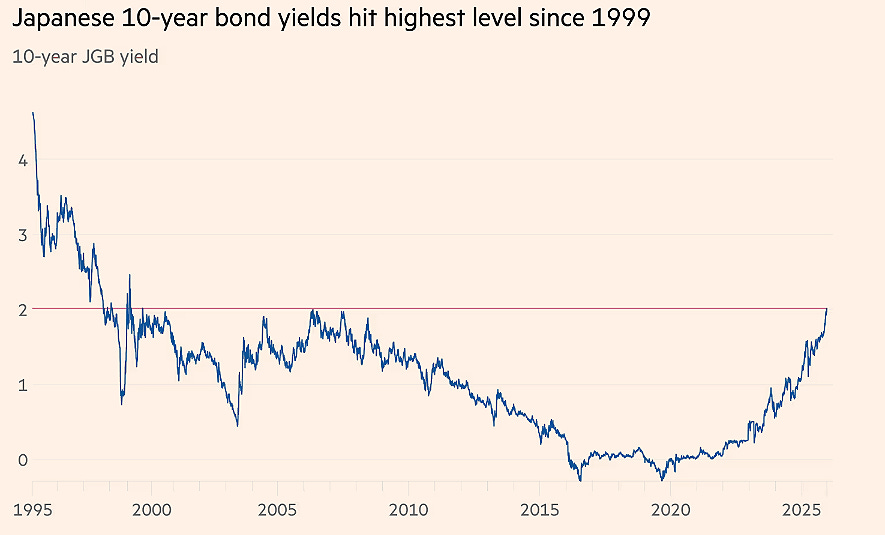

2. BOJ rate hike fallout will test global markets. Japan’s rate increase to 0.75% (highest since 1995) sent 10-year JGB yields above 2% for the first time since 1999.

This week will reveal whether yen carry trade unwinds accelerate. German 30-year yields already hit 2011 highs on repatriation fears. Currency markets are likely to remain volatile.

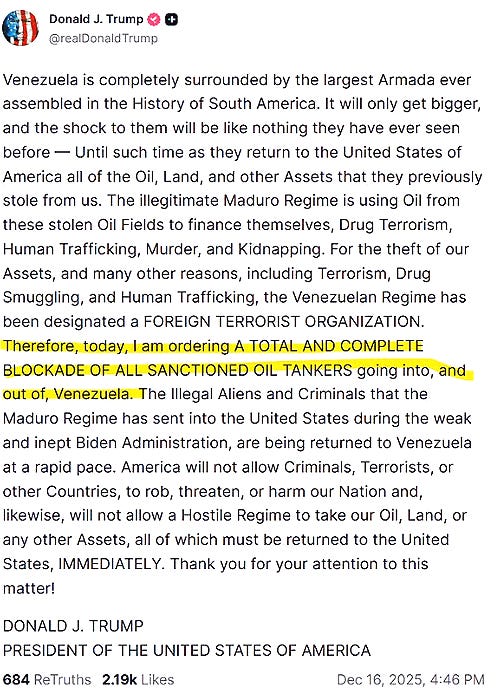

3. Trump’s Venezuela blockade faces its first enforcement test. With 11 Navy ships deployed, the “total and complete blockade” of Venezuelan oil tankers announced December 16 is now being enforced. Some sanctioned vessels have already diverted. China has backed Maduro. Watch for the first interdiction and Beijing’s response.

4. France and EU trade policy face critical tests. French lawmakers failed to agree on a 2026 budget on December 19, forcing a potential rollover of 2025 spending and raising deficit concerns. The EU-Mercosur trade deal was delayed to January after farmer protests and French-Italian opposition. Both issues continue to compound European political and market risks.

5. Holiday-shortened markets increase volatility risk. Thin liquidity from Christmas Eve through Boxing Day is likely to amplify price swings. Key data drops today (U.K. GDP and China’s commercial bank loan prime rate decision), Tuesday (U.S. GDP, durable goods) and Friday (Japan Tokyo CPI). Year-end positioning could exaggerate moves in currencies and rates.

6. Thailand set for snap general elections. Thailand will hold a snap general election on February 8, 2026, after Prime Minister Anutin Charnvirakul dissolved parliament last week due to rising political pressures and the threat of a no confidence vote. The Election Commission has set candidate registration for